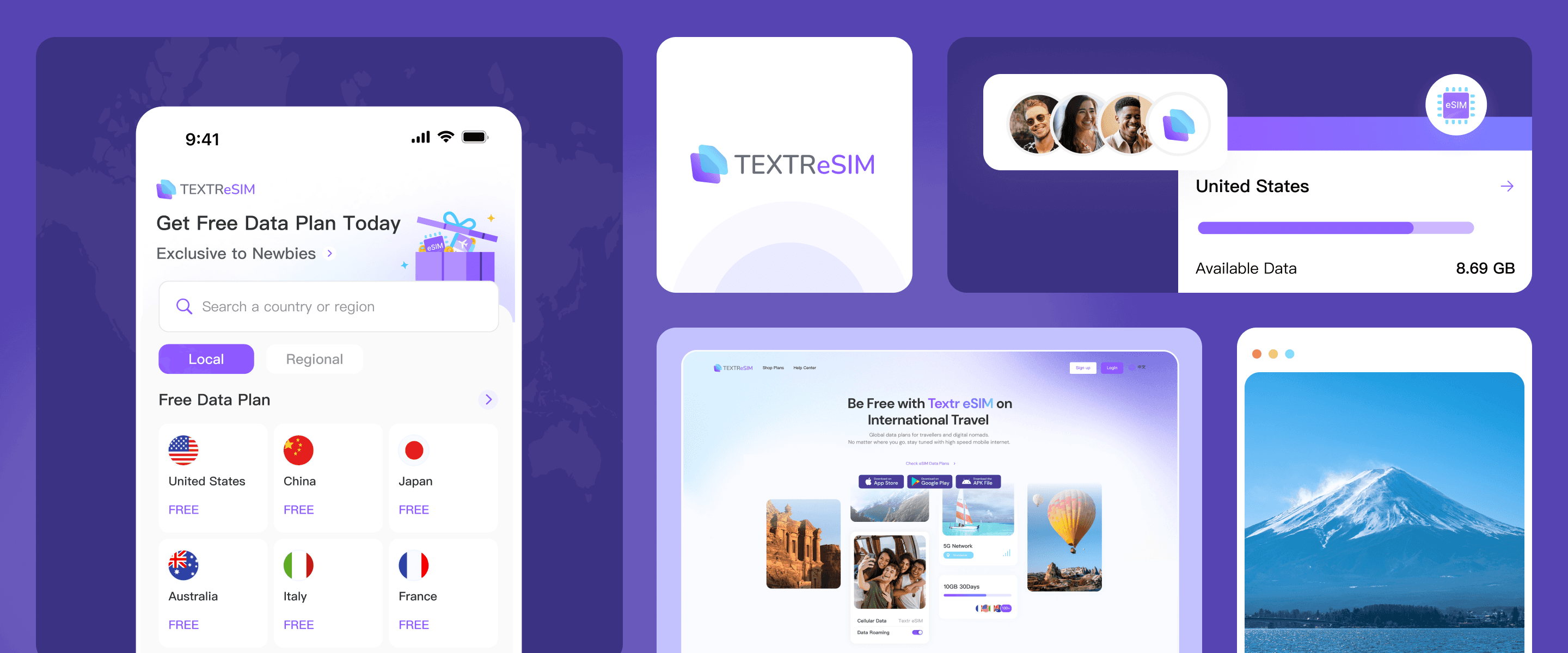

Unfamiliar Tech to Trusted Travel Utility — 800,000+ Users in 130+ Countries

Textr eSIM is a global data plan product for travelers in 130+ countries. In early 2022 it was a simple MVP with unclear install steps, no compatibility checks, and low user trust—driving high support volume.

With access to millions of PingMe/WePhone users, I led research (large-scale surveys + interviews + usability tests + ticket analysis) to pinpoint the biggest drop-offs, then designed the end-to-end experience across app, web, and a shared design system—helping scale Textr eSIM to 800,000+ users.

View live site

The impact

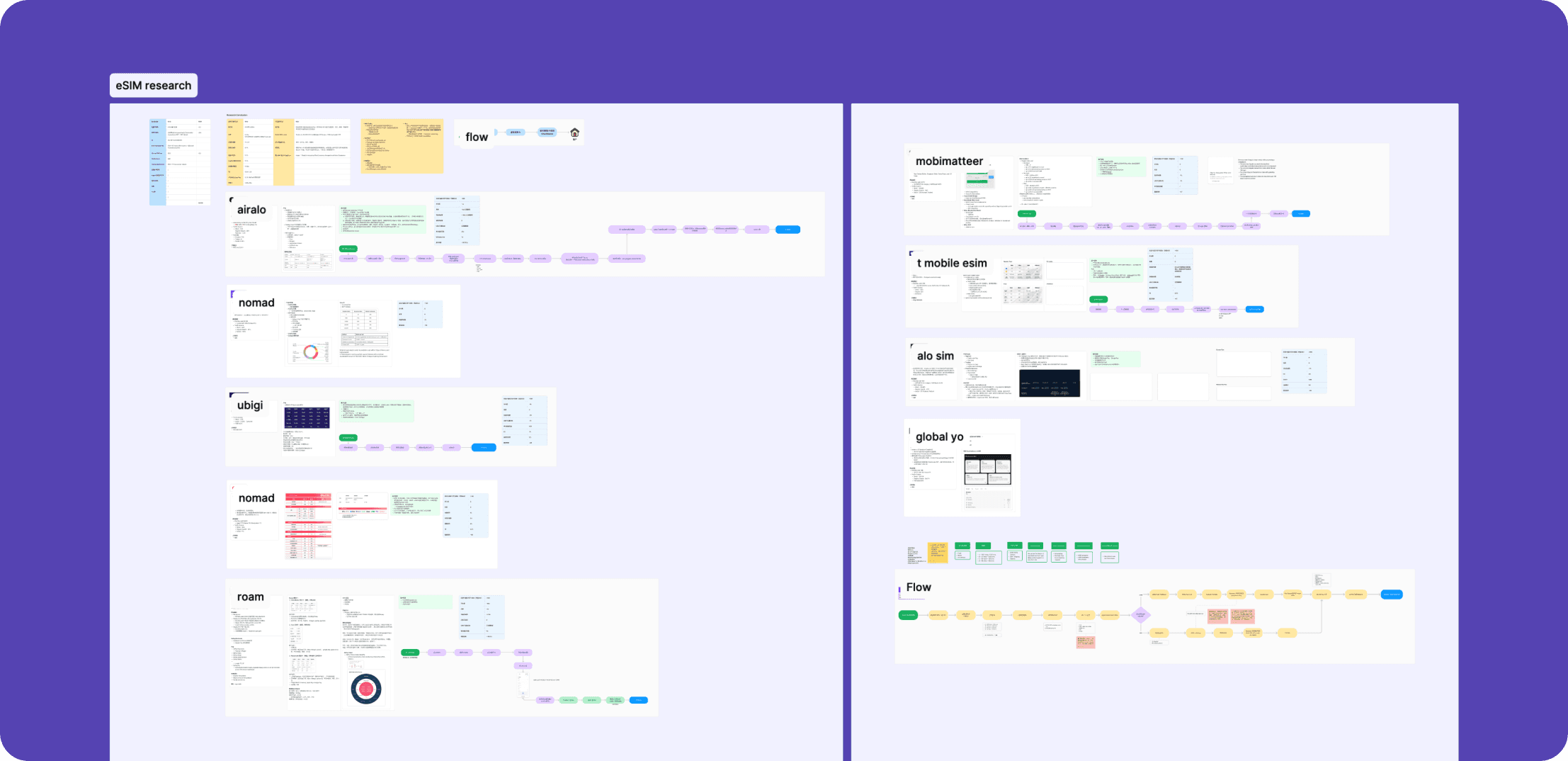

Competitive & Market Analysis

We broke down flows from Airalo, Holafly, Nomad eSIM, and carrier-provided eSIM packages.

In reviewing our competitors, two key insights stood out:

1.Lack of Clear Compatibility Check Before Purchase:

Most competitors did not offer a straightforward or prominent phone compatibility checker upfront. Users often had to dig through FAQs or find out post-purchase if their device would support the eSIM. This created a lot of uncertainty and hesitation.

2.Inconsistent Network Provider Information:

Additionally, competitors often did not specify which local network providers supported each plan. For example, a user buying a plan for the US might not know if they’d be on T-Mobile or AT&T. That kind of transparency was missing, and it’s something we identified as an opportunity to build trust.

Opportunity Space We Identified:

Our opportunity wasn’t just about installation timing. It was about providing a clear compatibility check before purchase, more transparent regional coverage details, and highlighting the network providers behind each plan. By doing this, we could reduce anxiety and help users make more informed, confident choices before they hit “buy.”

Biggest Pain Points

Lack of Clear Installation Guidance

Many users were confused about how to install the eSIM and whether their device was compatible. They didn’t have a clear, step-by-step guide tailored to their device (iOS or Android), which led to uncertainty.

Complex and Unclear Purchase Flow

The original purchase flow didn’t highlight compatibility checks or explain the steps clearly. Users didn’t know which devices were supported upfront or what to expect during checkout, making the process confusing.

Difficulty in Managing Multiple Data Plans

Users needed a better way to manage different eSIM data plans and device statuses, especially if they had multiple devices or family members. The original interface didn’t make it easy to see plan statuses or switch between devices.

Problem Statement

“Travelers need a reliable and predictable way to install and activate eSIM without fear of failure, uncertainty about compatibility, or confusion during the installation and activation journey.“

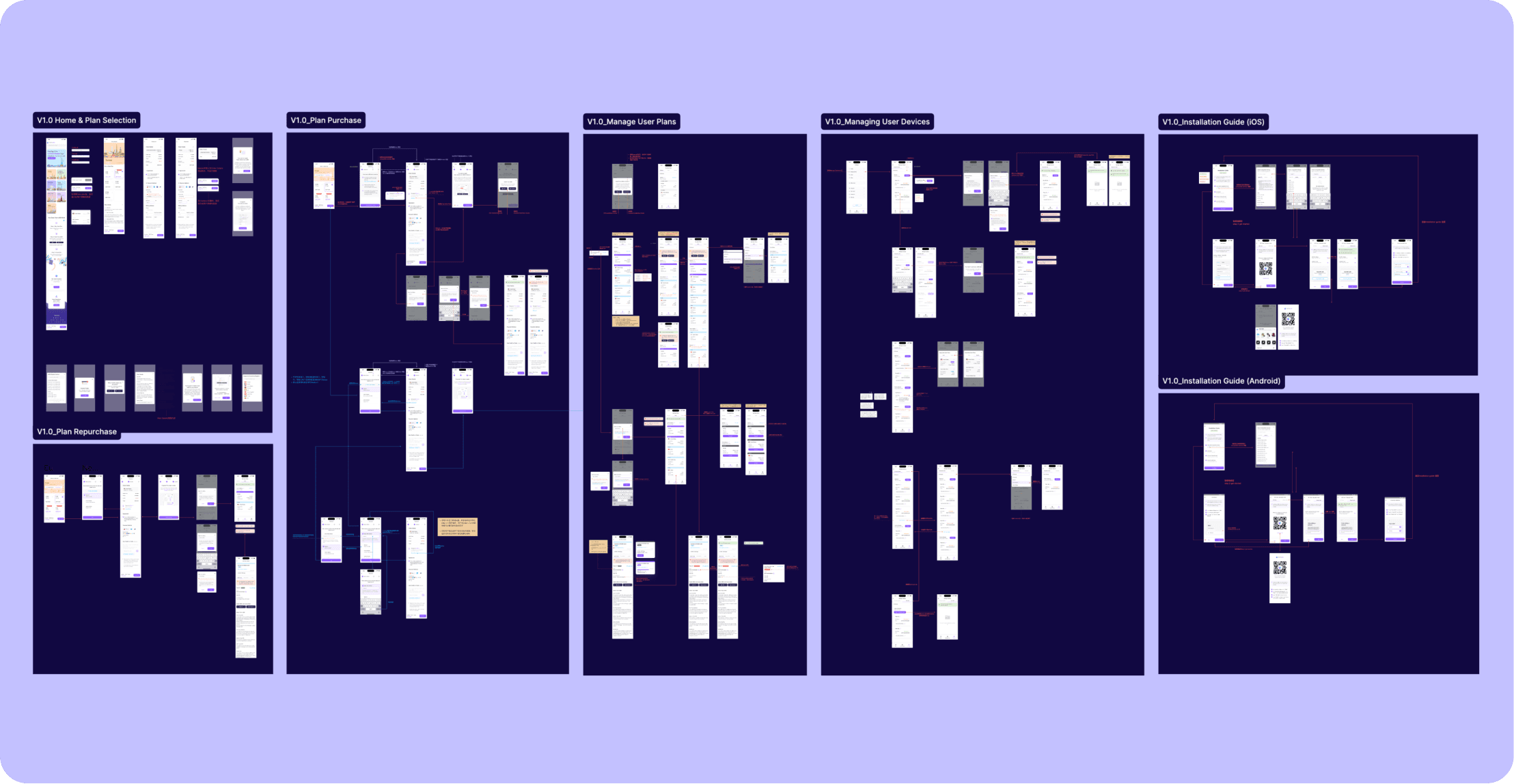

Building the solution

Foundation phase

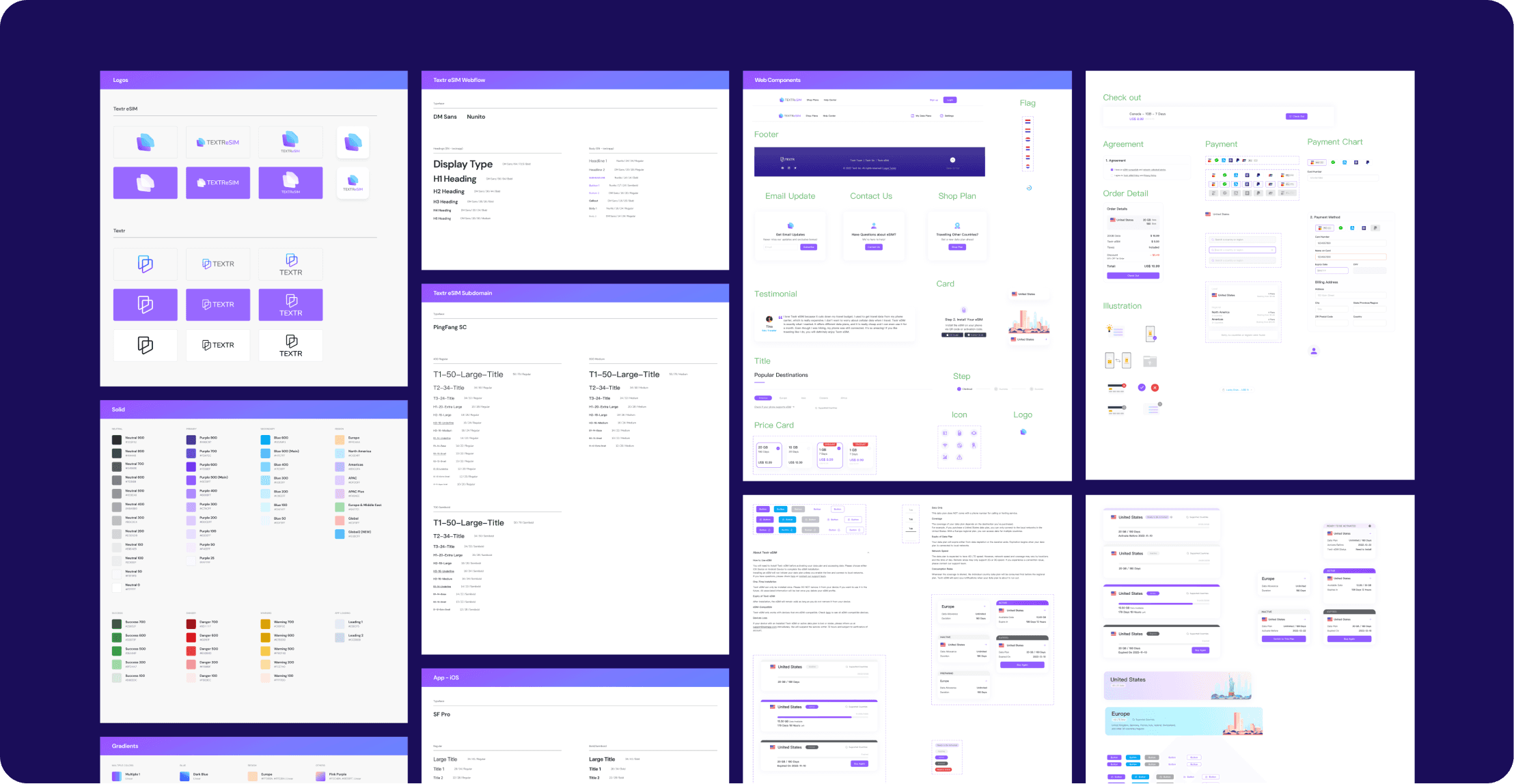

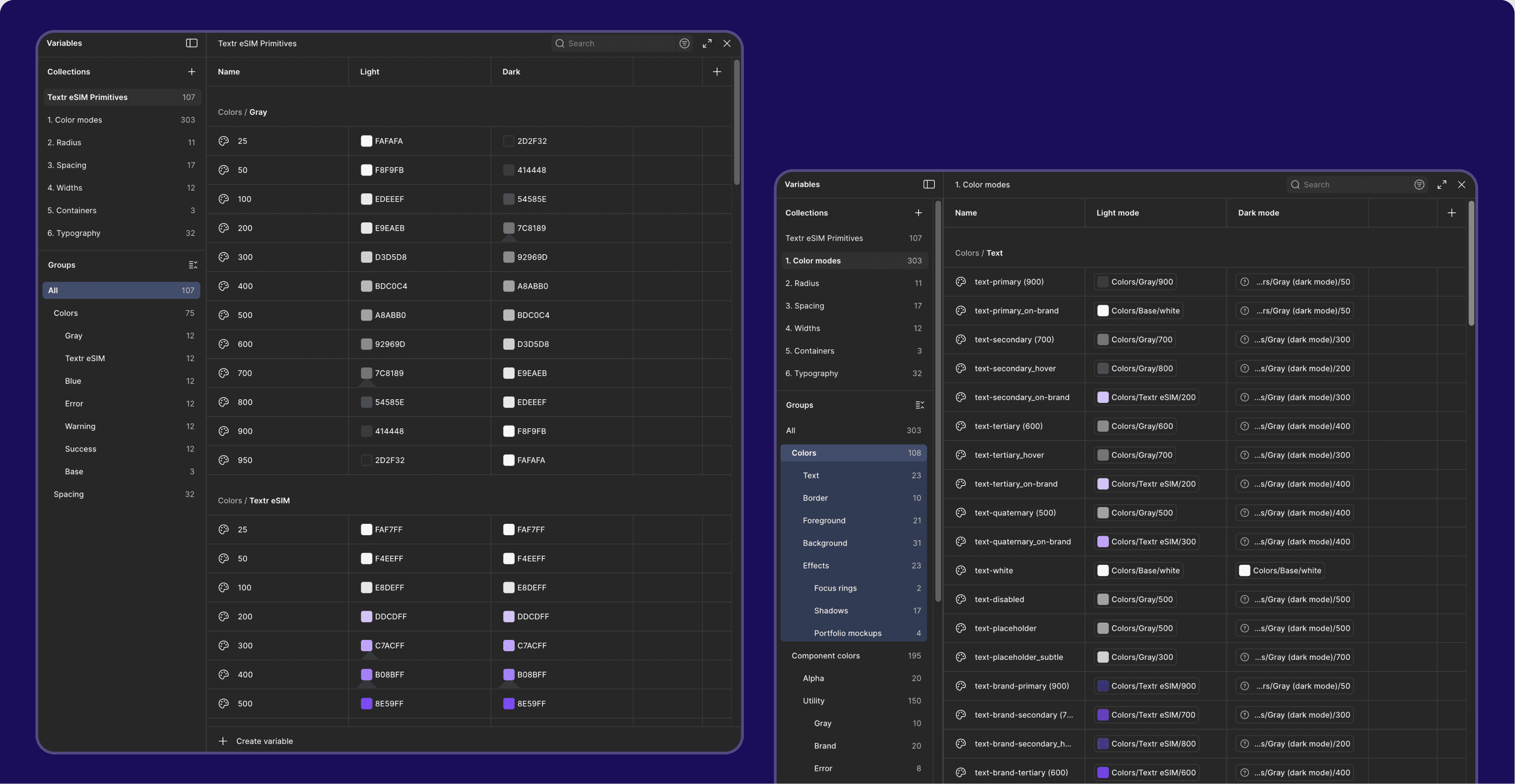

We started with the basics: creating a brand identity that felt trustworthy and approachable.

The logo design process became a metaphor for our larger mission - maintaining connection to the familiar (Textr brand) while embracing innovation product (Textr eSIM). Additionally, I developed a style guide and scalable design system to ensure consistency and adaptability.

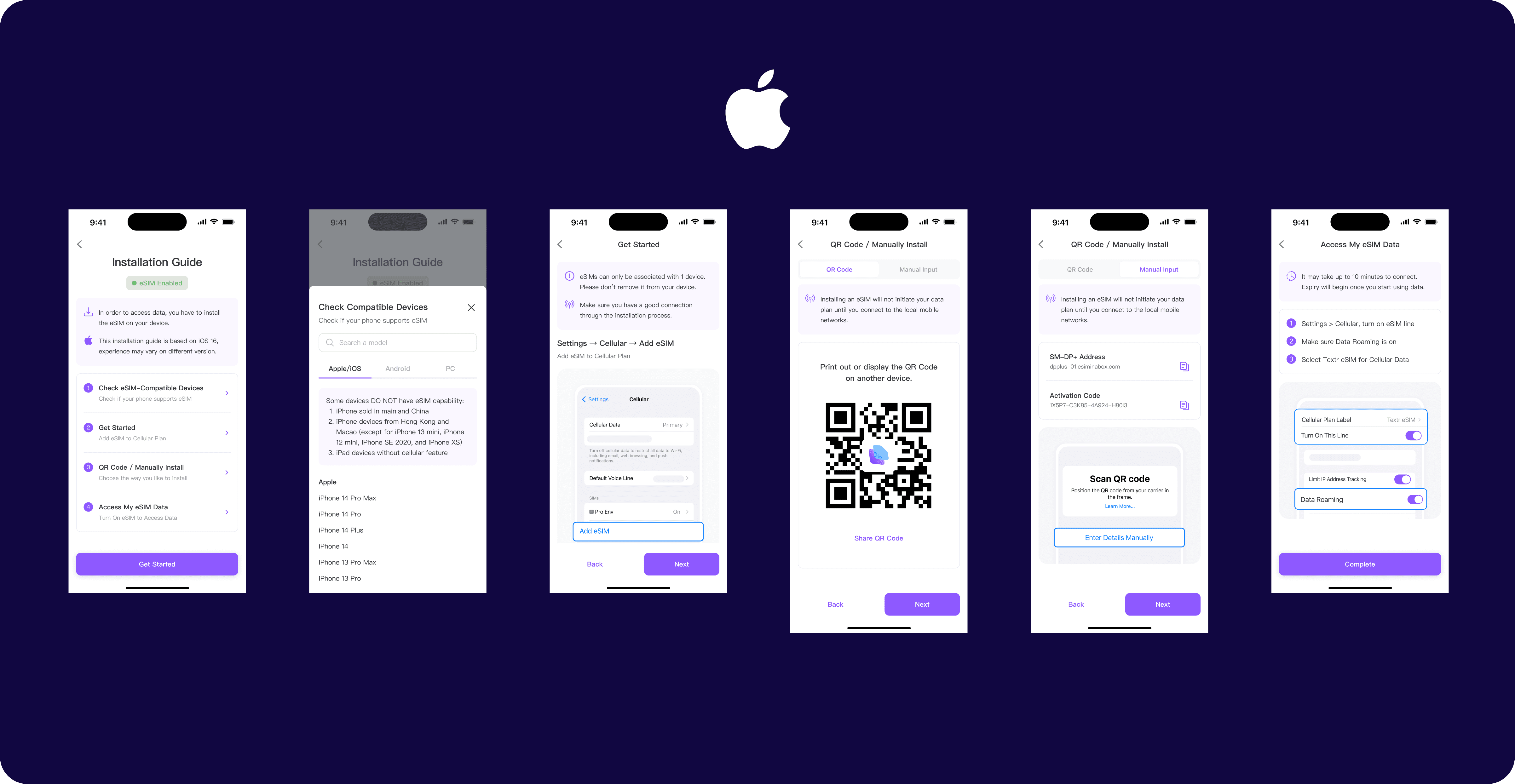

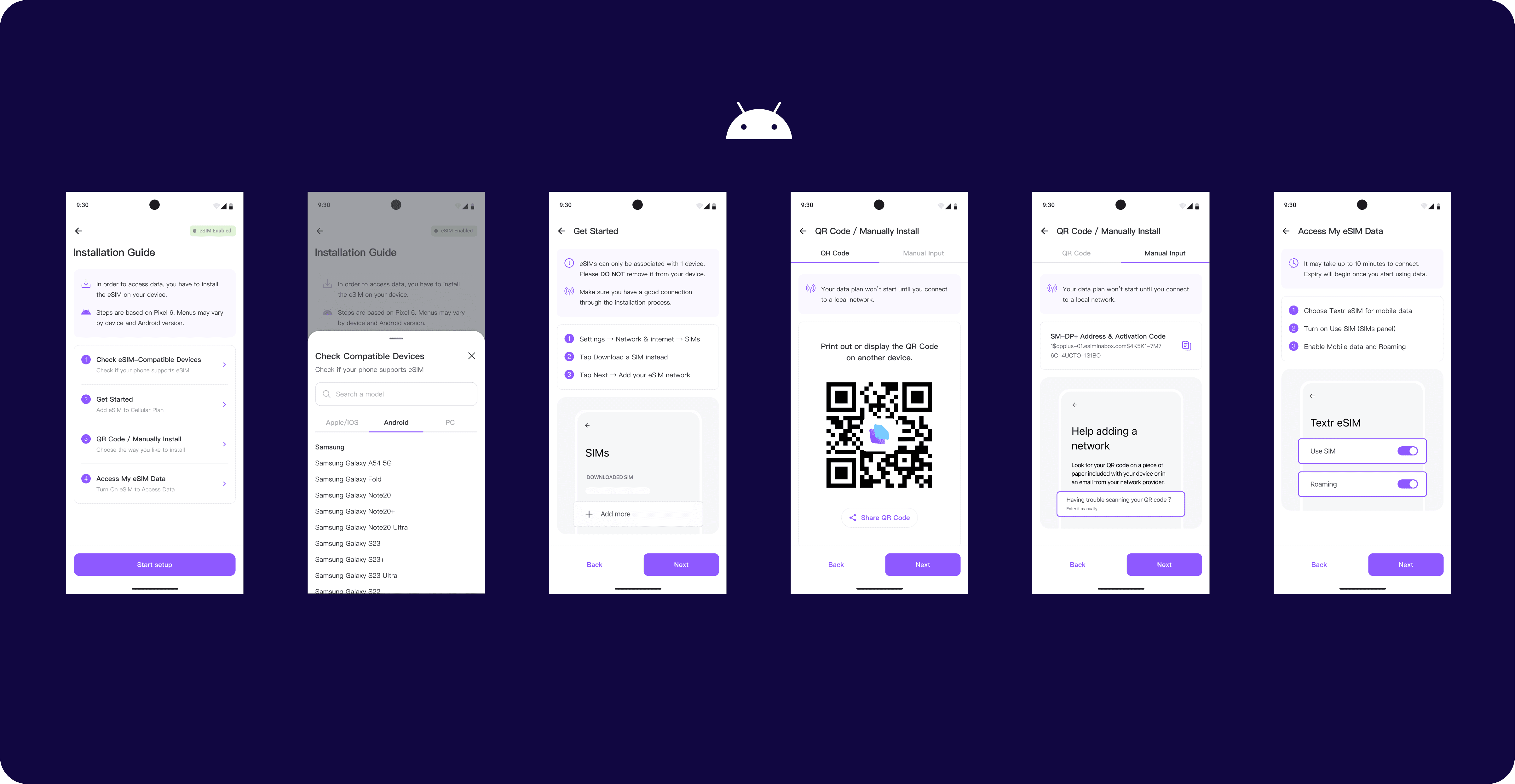

1.Solution for Installation Guidance

Solution

Introduced a tailored installation guide for both iOS and Android users. This included step-by-step instructions and device-specific mockups so users could confidently install their eSIM and confirm compatibility right from the start.

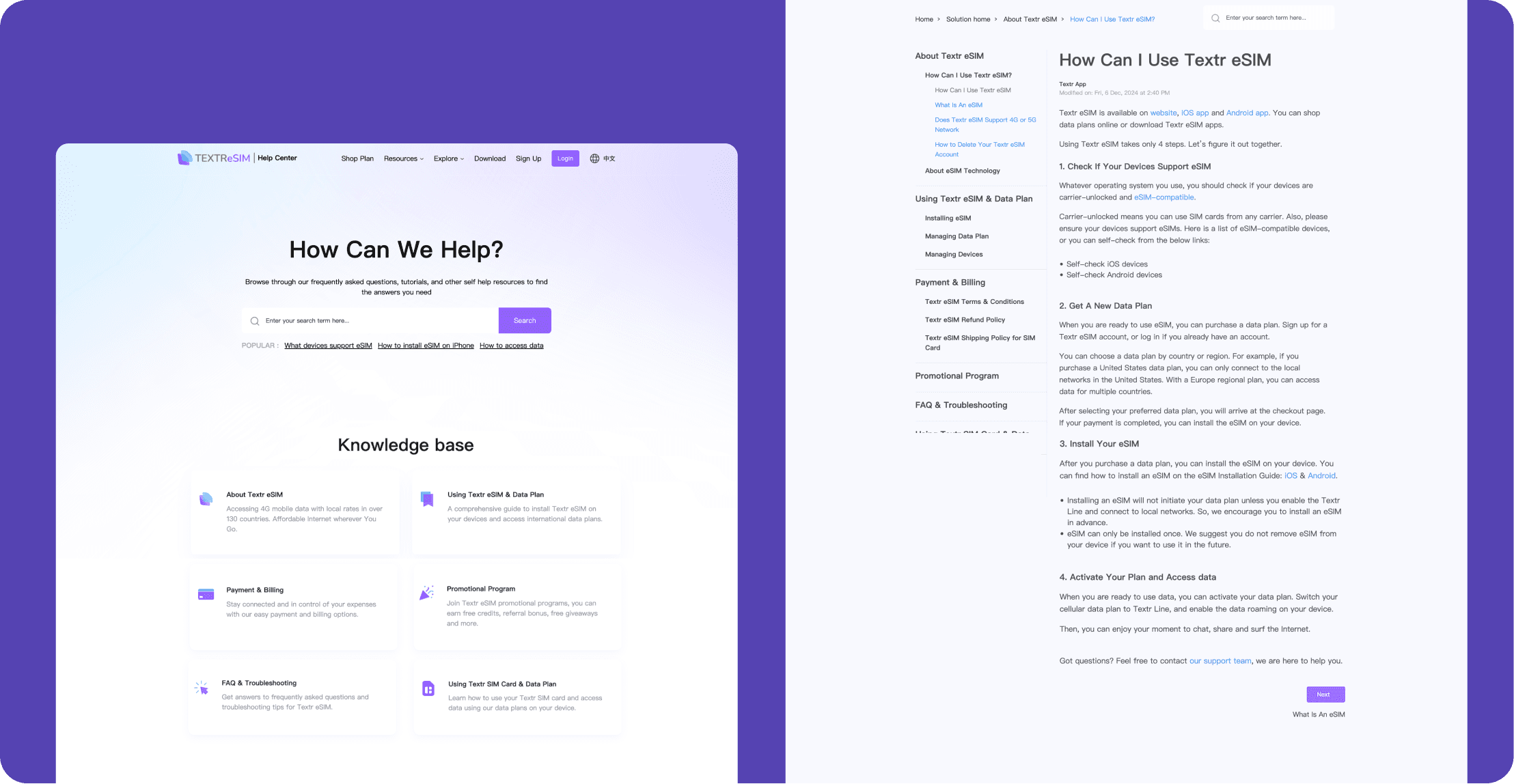

Recognizing that eSIM technology was unfamiliar to many users, I also partnered with our marketing team to create a comprehensive Help Center for our users.

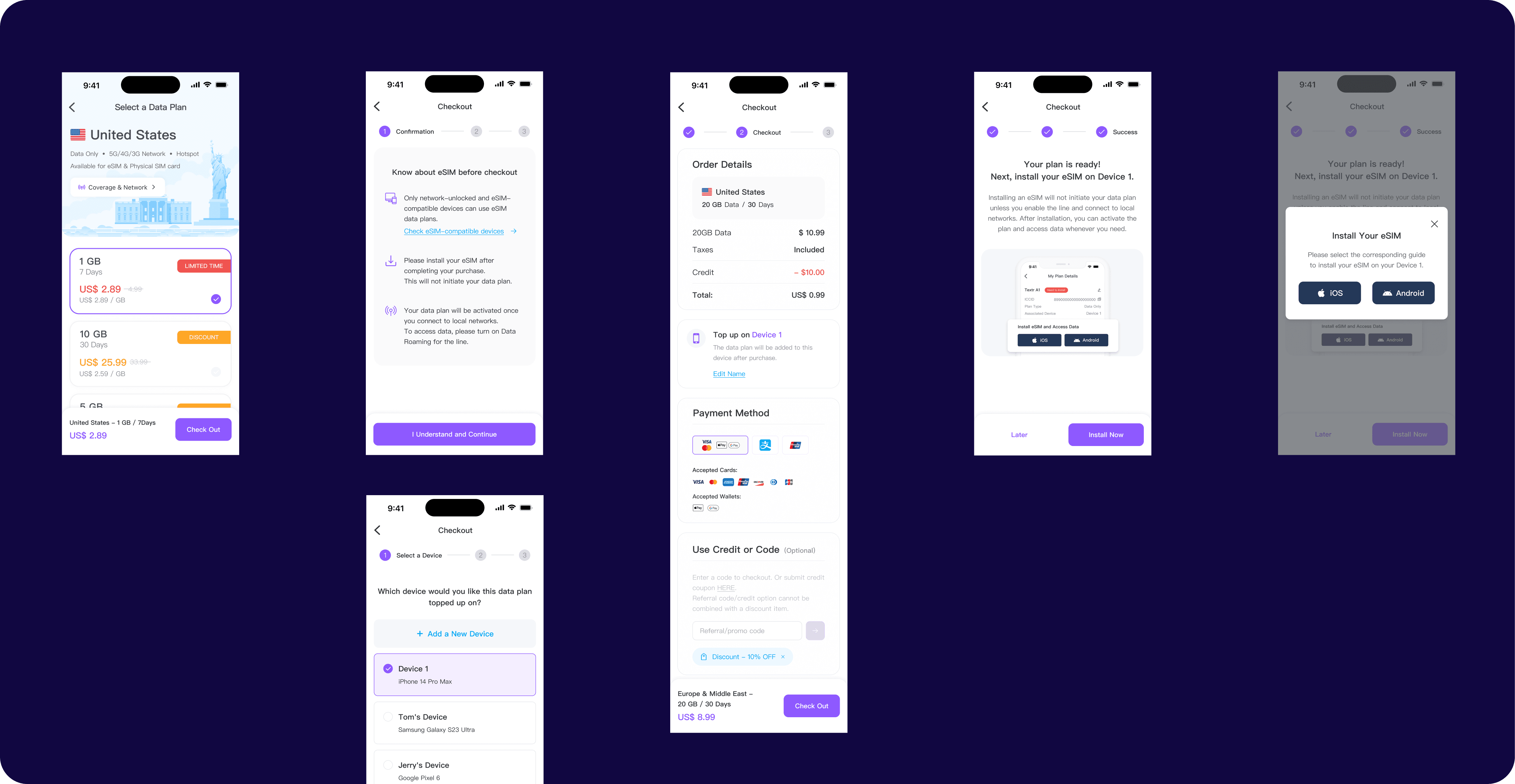

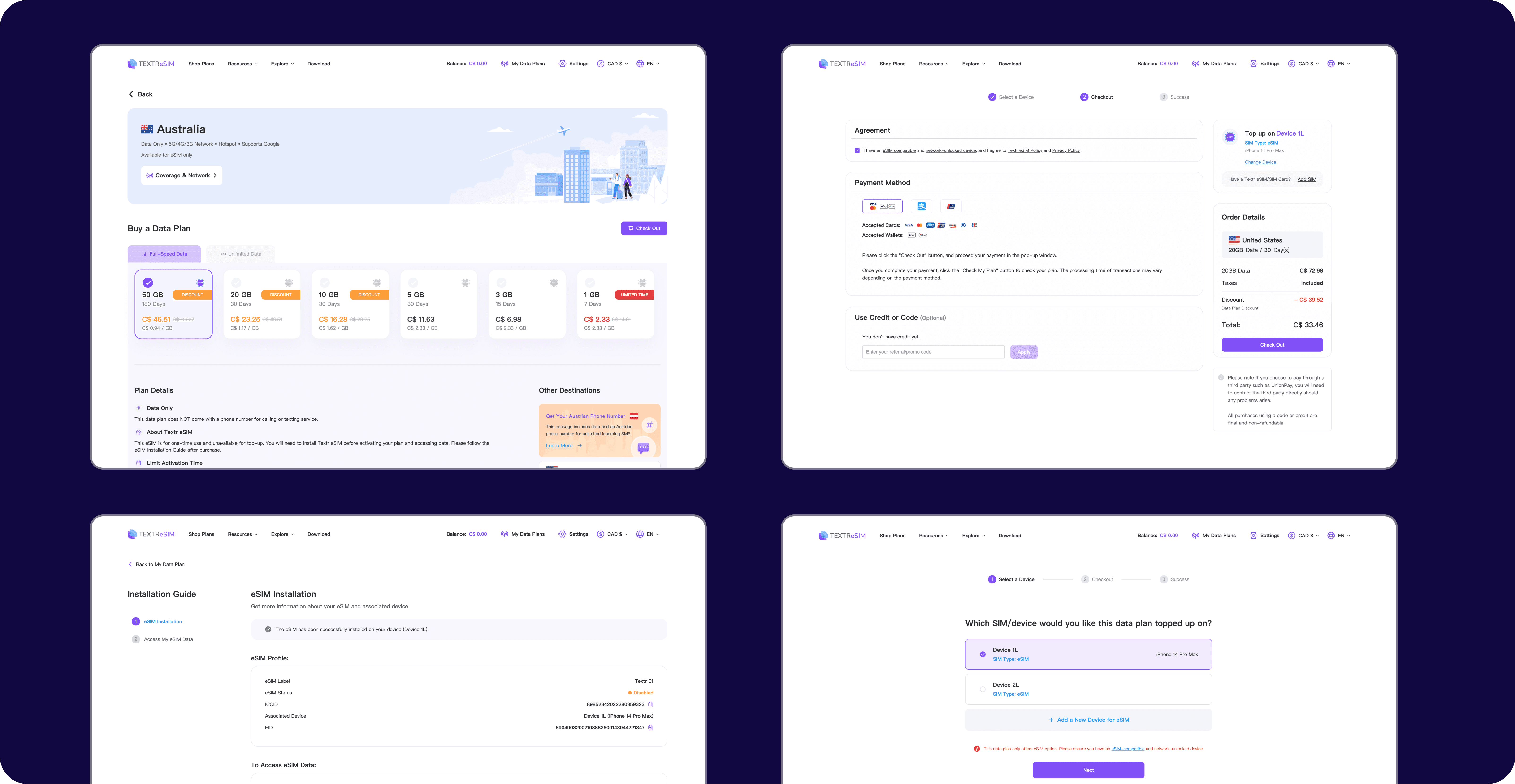

Solution for Purchase Flow Simplification

Solution

We redesigned the purchase flow to include a compatibility check before checkout and made each step of the process clear. We added a step indicator and allowed users to easily see if their device was supported. We also included a promo code field and clear payment options to streamline the experience.

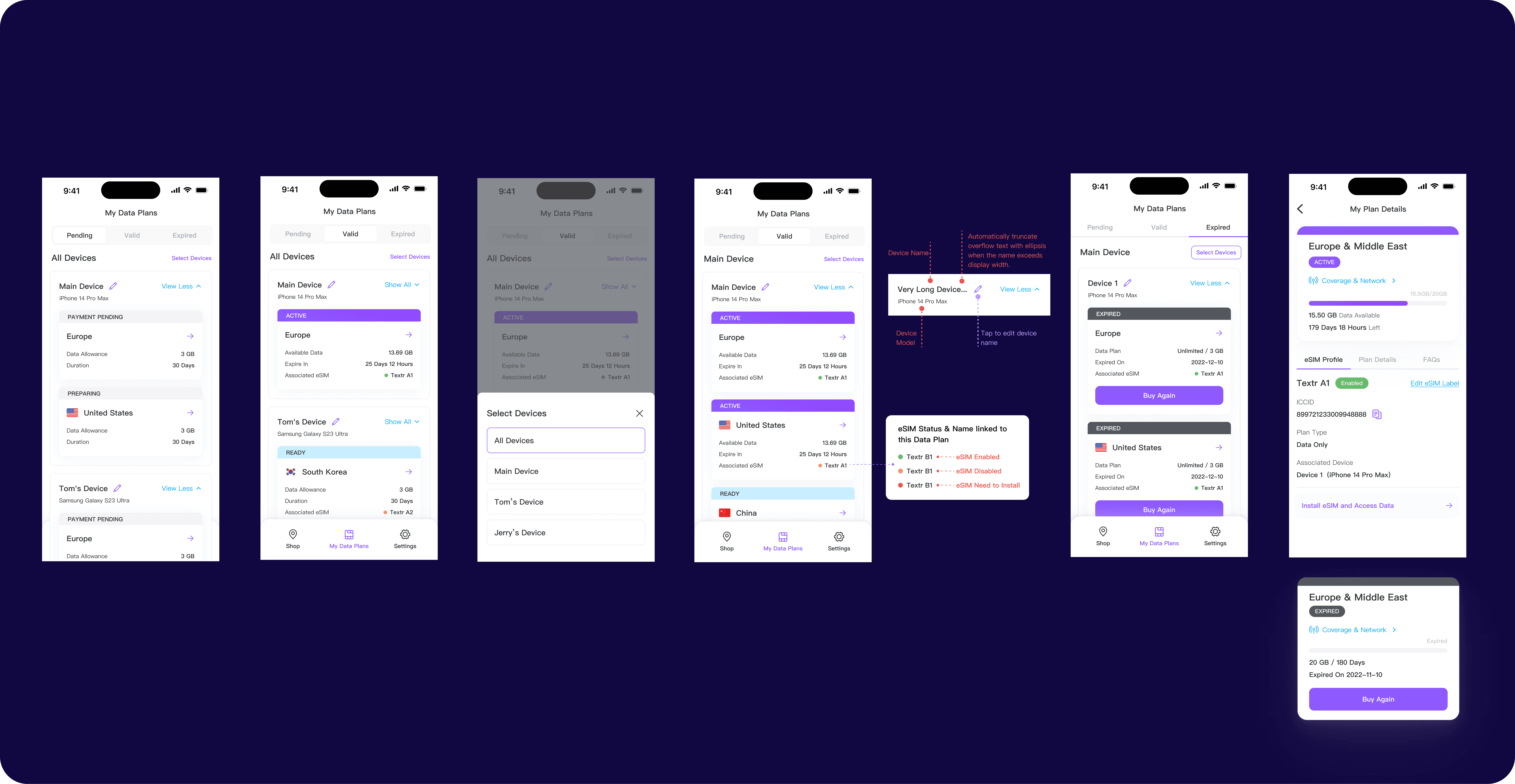

3.Solution for Managing Data Plans

Solution

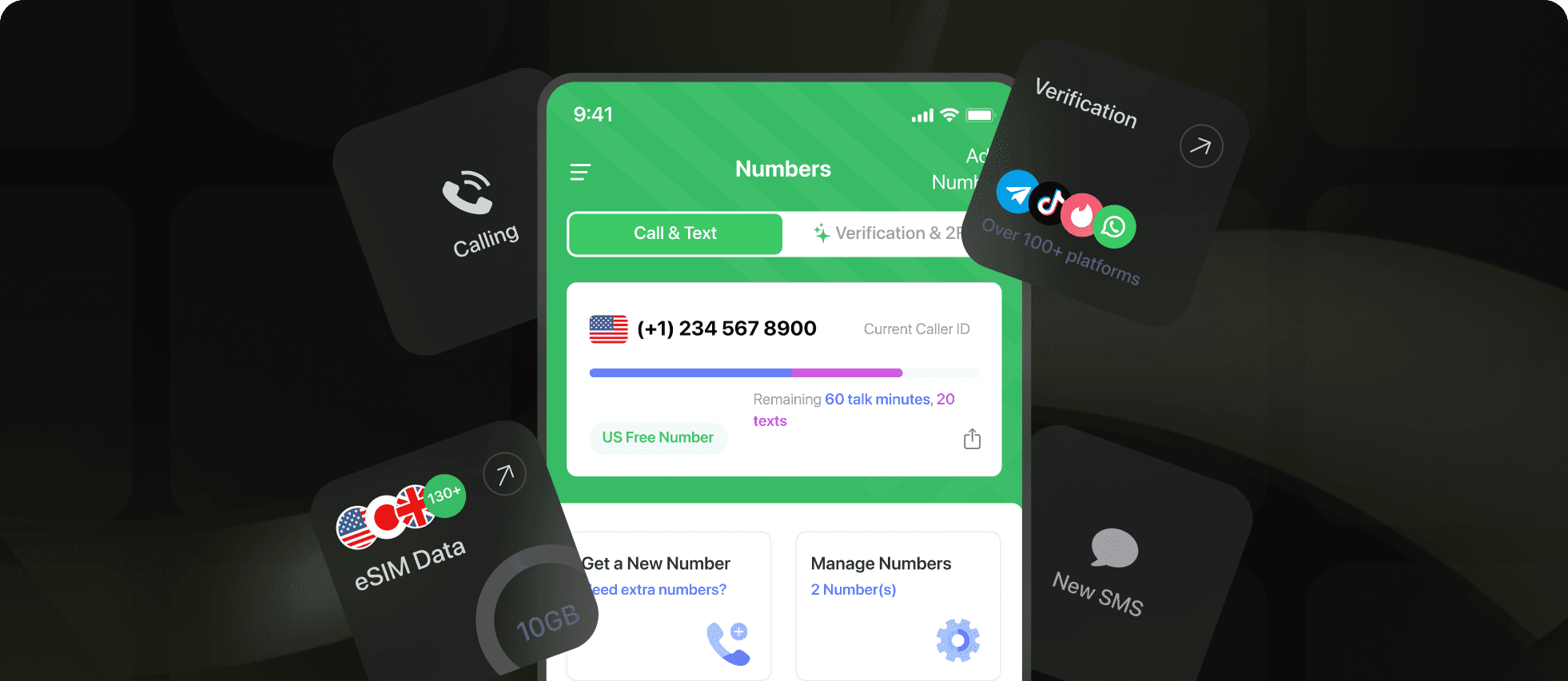

We created a more intuitive dashboard for managing multiple data plans. Users can now view different plan statuses (like Active, Ready, or Pending) and switch between devices easily. This makes it simple to keep track of multiple eSIMs, especially for users managing plans for family members.

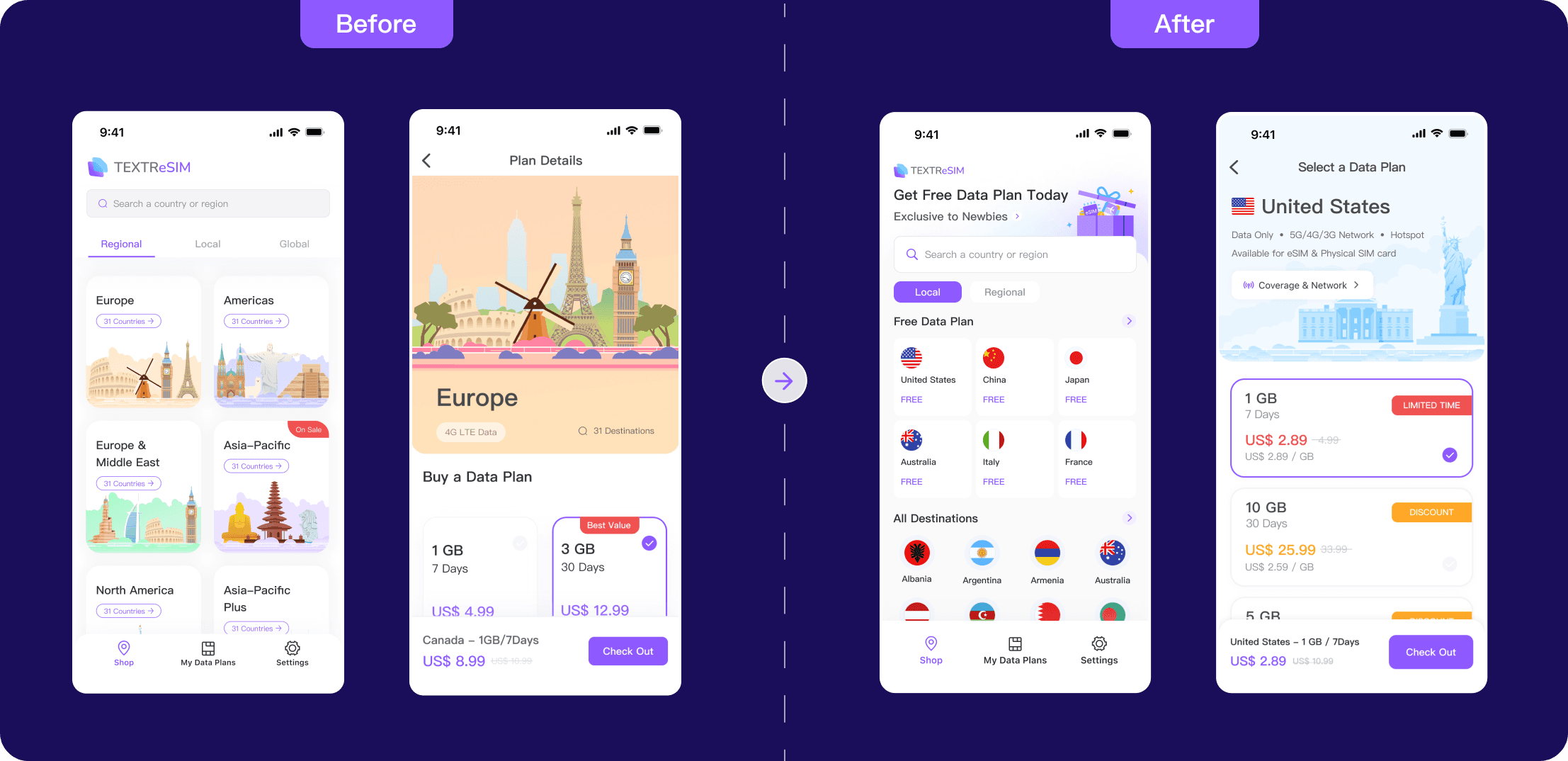

Future Enhancements and Data-Driven Optimizations.

As we iterated on new versions and gathered more data on actual user behavior—using tools like user analytics and purchase tracking—we discovered a clear shift. Initially, the focus was on regional plans because local partnerships were limited. However, as we expanded our local plan offerings, data showed that users were more interested in purchasing country-specific local plans rather than broad regional packages.

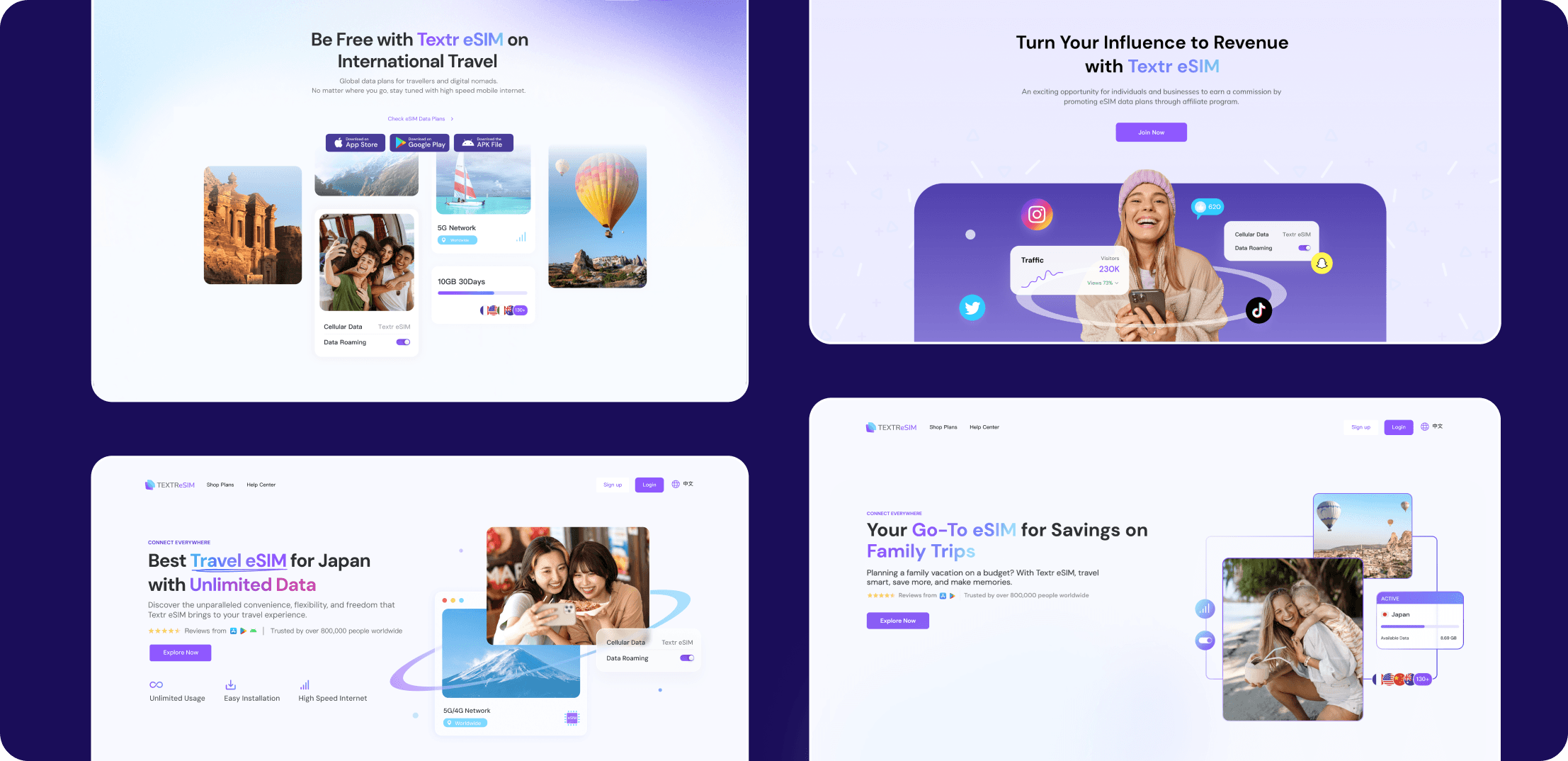

In response, we redesigned the homepage to prioritize local plans. We placed the most popular local destinations—like the US, China, and Japan—prominently on the homepage based on user demand patterns. We also added a banner area that can be customized for different marketing campaigns, such as offering free data for new users or highlighting limited-time promotions.

This optimization ensured that users could quickly find the local plans they needed and navigate more intuitively. It was a data-driven update that aligned our offerings with actual user preferences.